Beware of any emails informing you of a tax refund – they are likely to be fraudulent.

The tax filing season has brought with it a host of scamsters who will try anything to gain access to the money in your bank account. The new auto-assessment process introduced by the South African Revenue Service (Sars) may have exacerbated the problem, because taxpayers may think any emails or SMSes they receive are part of the new process.

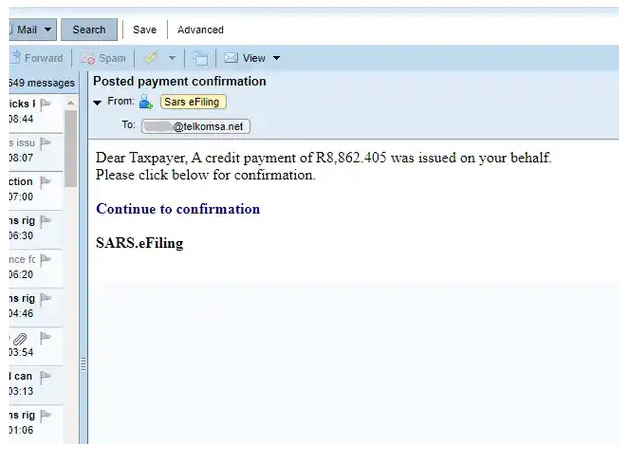

A scam email will look something like this:

It will tell you that you have received a tax refund from Sars – in many of these emails, the amount is around R8000. It will include a link, which will take you to a website that looks like an authentic SARS webpage, with links to the various banks.

If you click on a bank link, it will take you to a webpage that looks very similar to your authentic online banking site. You will be required to enter your log-in details, as you would when doing your online banking.

If you enter these details, you can expect unwelcome withdrawals from your bank account – the scamsters will have achieved what they set out to achieve. This technique is known as phishing, and if you provide your log-in details and money is stolen from your account, your bank is unlikely to reimburse you..

So how do you know whether an email is fraudulent or not?

First, Sars has your bank details as a taxpayer and will deposit any refund straight into your account. It may inform you via email or SMS that such a refund has been made, but it will not require you to log in to your bank’s online banking site.

Second, you need to check the email address of the sender. While the “name” of the sender may be an authentic-looking “Sars eFiling”, if you click on the name to ascertain the sender’s email address, it will bear no relation to a Sars address.

Never log in to online banking unless you are 100% sure that you are on your authentic online banking site. These sites are secure, and will have a lock icon and/or the word “secure” in the webpage address (URL).

Always check with Sars or your bank if there is any doubt.

Article: IOL