One of the more notable changes for expats in this year’s proposed amendments are the rules relating to contributions made to South African retirement funds, and those made to tax-free savings accounts.

Generally, a taxpayer may claim a tax deduction for contributions made to a local retirement fund – limited to the lesser of 27,5% of their taxable income, or R350 000, each tax year. At the same, a taxpayer may contribute up to R36 000 to a tax-free savings account each year; and as long as that taxpayer remained within the contribution limits, any gains realised from these investments are treated as tax-free.

So, what has changed – and why?

CEASING TAX RESIDENCY

To best understand these changes, one needs to understand what ceasing tax residency means.

When a taxpayer ceases to be a resident of SA for tax purposes, the South African Revenue Service (SARS) requires them to formalise this change. In essence, they go from being a person who is liable to tax in SA on all worldwide amounts, to being liable to tax only on amounts that arise from a source in SA. SARS must confirm one’s non-resident status following an application by the taxpayer – i.e., it is not automatic.

SA has seen an exodus of taxpayers in recent years, with the majority opting to formally cease their tax residency. Numerous factors such as crime, loadshedding, and better opportunities abroad, to name but a few, have spurred this migration. However, at the same time, over recent years, SA has seen considerable proposed changes in the tax laws targeting expats – especially those who cease to be tax residents.

This year is no different.

SPLITTING HAIRS

When a person ceases to be a tax resident, their 12-month tax year splits into two: the portion of the year in which they were a tax resident, and the other portion in which they were a tax non-resident.

For example, if one ceases to be a tax resident on 1 June 2022, their tax year of assessment as a tax resident would have begun on 1 March 2022, but would be deemed to have ended on 31 May 2022 (i.e., a 3-month year of assessment as a South African tax resident). Their tax year as a non-resident began on 1 June 2022 and ended on 28 February 2023 (i.e., a 9-month year of assessment as a tax non-resident). Both tax years (the 3-month and 9-month periods respectively) fall within a single 12-month tax period.

While the taxpayer still submits one tax return for the (12-month) tax year, SARS will soon take these two periods into account when considering their local retirement fund and tax-free savings account contributions.

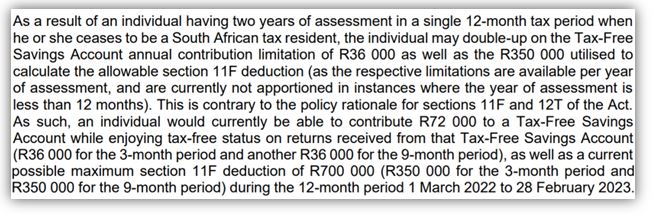

While this is nothing new, the National Treasury has stated, on record, that this amendment intends to address an anomaly created by the split-year treatment applicable to taxpayers who cease tax residency:

This means that, currently (and previously), a taxpayer could contribute up to double the annual allowable contribution limits in the year that they cease to be a tax resident, thereby doubling up on these benefits from a tax perspective.

In practice, however, the current tax return form on e-Filing, and of course SARS in determining the tax payable by a taxpayer, has not taken these doubled-up contribution limits into account. Perhaps certain non-resident taxpayers should, therefore, rightly wonder whether SARS currently owes them a refund.

Nevertheless, National Treasury has proposed that from 1 March 2024, contributions made to a local retirement fund or tax-free savings account, in the year where the taxpayer ceases to be a tax resident, will be capped in relation to the time of the year that they ceased tax residency. The new limitations will be determined based on the ratio of days in that tax period (i.e., pre-, or post-cessation), against 365 days.

KEEPING AHEAD OF THE CURVE

While these changes may hinge on the technicality of counting your days, it remains crucial for expat taxpayers to understand the practical ramifications – especially those who intend to cease their South African tax residency and have not pulled the trigger on it just yet.

From the perspective of following the correct tax strategy, upfront planning becomes essential where it is needed to understand the who, what, when, why, and how – this is the key to success!

Where the prudent due diligence route is not followed, and the first mover advantage is lost, the benefit of aligning with the tried and tested formula is lost, meaning there is no guarantee of a predictable outcome from SARS.

While it is seldom too early for tax planning, it can be too late!

Article: TaxConsulting