On resignation, you are allowed a full refund of your retirement fund contributions with or without interest, depending on the rules of the fund.

Congratulations on the exciting new opportunity and the new adventure that lies ahead! This is a question I believe many South Africans are dealing with these days, as more and more of us are moving abroad to work there either temporarily or permanently.

In the case of retirement, the retirement date is mentioned in the fund rules at which point the compulsory annuitisation principles may apply and you will not be allowed to take the whole pension. Most possibly a maximum of only one-third of the fund value can be taken as a lump sum with the balance (two-thirds) used to purchase a compulsory annuity.

For this scenario, I am, however, assuming you are opting to withdraw from your company fund as you mentioned a resignation and therefore the withdrawal tax table will apply.

On resignation, you are allowed a full refund of your retirement fund contributions with or without interest, depending on the particular rules of the fund. You are not compelled to withdraw the whole fund value, as a lesser amount can be taken as a lump sum instead and have the balance transferred to an approved retirement annuity fund or a preservation fund.

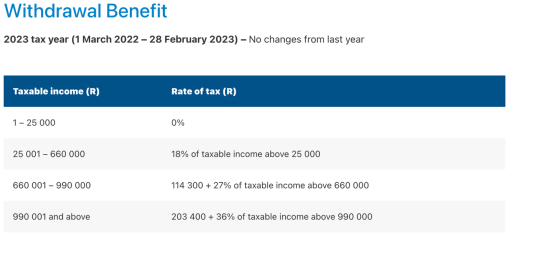

If you have not taken any previous withdrawals from a retirement fund, you will be allowed to take the first R25 000 at 0%, whereafter the following sliding scale will apply:

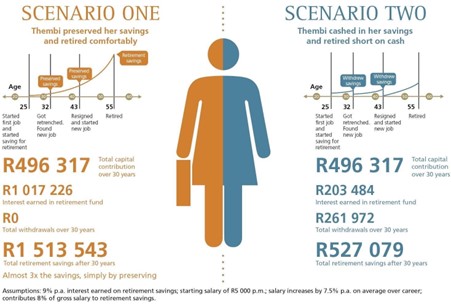

With recent legislation changes pertaining to retirement funds, I would strongly recommend reinvesting your local portfolio into a preservation fund. Regulation 28 has recently been revised, increasing the offshore allowed limit from 30% to 45%. I would recommend keeping these funds invested until you actually retire one day. The power of preservation and not touching your savings really has a life-changing effect and can lead to an entirely different retirement outcome in the longer term:

Article: Moneyweb