An amended set of rules that describes the procedures for tax objections and appeals for the alternative dispute resolution (ADR) process, as well as the hearing of appeals before the Tax Court and the Tax Board, has been published.

Dispute resolution experts have welcomed the new rules, which became effective on 10 March – describing them as a “positive step forward in many ways” and by and large in favour of taxpayers.

Nico Theron, founder and managing partner of Unicus Tax Specialists SA, says the 2014 rules were amended and draft rules were published for comment in 2018. However, nothing came of this.

“My understanding of the new amended rules is that they are mainly favourable towards taxpayers and that is perhaps why they were not published in draft this time.”

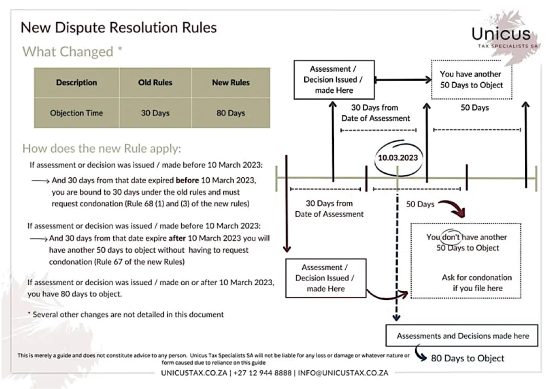

The biggest and best change, according to Theron, is the time taxpayers now have to object to an assessment or decision by the South African Revenue Service (Sars).

Under the old rules they had 30 business days, but this has now been extended to 80 business days.

Webber Wentzel partner Joon Chong says the new 80-day objection period excludes the 30-day extension for taxpayers who request additional time on reasonable grounds, and the up-to-three-year extension for requests based on exceptional grounds.

Facilitator independence

Chong says one of the biggest issues with the ADR process in the 2014 rules was the perceived lack of independence of the facilitator. The facilitator was appointed by Sars and was a Sars employee.

The rules have been amended to remove the requirement that a senior Sars official establish a list of facilitators.

The new rules provide that the facilitator must have appropriate tax experience and be acceptable to both Sars and the taxpayer. Although the facilitator, once accepted by all parties, is still appointed by a senior Sars official within 15 days of the ADR commencement date, the rules now expressly provide that the facilitator must act independently and impartially.

“We welcome these positive amendments,” says Chong.

Theron notes that in terms of the new rules the facilitator has to provide a report within five days after the ADR meeting, and a final report no later than 10 days after the conclusion of the ADR process. He believes this is a more practical rule, as he has never seen a report issued after the conclusion of an ADR meeting.

Shortened time periods

Another welcome change to the rules is the ability of parties (the taxpayer and Sars) to agree to shortened time periods for various procedures if the timelines are not already regulated by the rules. The 2014 rules only allowed for parties to agree to extensions.

This will help to speed up the process, says Theron.

Where the Tax Court confirms or alters the Sars decision or assessment, Sars must issue the relevant assessment within 45 days of the registrar receiving the Tax Court decision.

“This is a good rule to have,” he says.

Abuse of process

Chong also highlights the fact that someone can currently be subpoenaed by the Tax Board clerk or the Tax Court registrar to attend an appeal hearing and give evidence or provide documents on issues relevant to the appeal.

The new rules however make it clear that the use of subpoenas should not be an abuse of process.

“If a party is of the view that the subpoena is not relevant or an abuse of process, the new rules provide for them to request the withdrawal of the subpoena.”

If this is not done they can apply to the Tax Board or Tax Court for the withdrawal of the subpoena. If it is withdrawn (by the clerk or the registrar), the aggrieved party can then apply to the court or board for the issue of the subpoena, she notes.

Theron advises taxpayers and their advisors to make sure they understand the transitional provisions that are set out in the new rules.

Chong explains that the new rules will apply to matters already underway. Requests for reasons, objections, appeals to the Tax Board or Tax Court, ADR, settlement discussions, or interlocutory applications that were instituted under the previous rules but have not been completed, will have to be continued and concluded under the new rules.

Article: Moneyweb