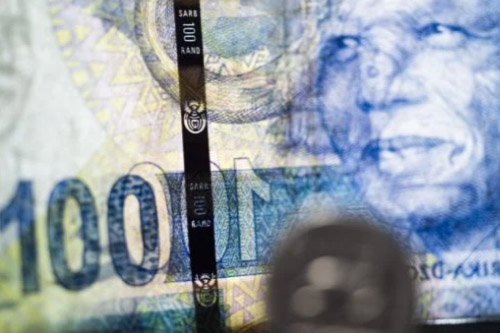

Here’s how much tax you will pay this year based on your earnings in South Africa

The South African Revenue Services (SARS) says that taxpayers will be able to file their tax returns from 1 July 2022. Taxpayers should also be

The South African Revenue Services (SARS) says that taxpayers will be able to file their tax returns from 1 July 2022. Taxpayers should also be

With some basic professional training with practical examples, understanding the basics of tax can easily be learned with basic arithmetic. In addition, the purpose of

With pressures mounting for SARS to collect more and more each year, payrolls need to ensure they remain squeaky clean to ensure they are not

The South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) is set to increase the repo rate this week – with consensus among most analysts

It has come to light in March 2022, that the Irish Tax Authority (ITA) has reached out to Airbnb Ireland UC (Airbnb), for the disclosure

New Rules Applicable to All It is important to note that the changes announced, applies retrospectively to everyone who has completed the Financial Emigration Process.

It often comes as a surprise to pensioners that they are still liable for tax. The bottom line is, if you receive an income above

Facts The nature of betting transactions in the casino industry, especially the table games of chance (for example, Roulette and Poker), makes it difficult to

When one weighs up his giving with the one hand and taking with the other, it’s difficult to assess whether South Africans will benefit overall

This has been a surprisingly tax-friendly budget, thanks to tax collection significantly exceeding expectations. Tax revenue collections for 2021/22 are expected to exceed last year’s

CTF Services, 21 Kroton Street

Roodepoort 1709

Phone: +27 11 781 2588

E-mail: info@ctfsa.co.za

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. See our Disclaimer

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.