Home office expenses and tax deductions

The Covid-19 pandemic has caused great hardshipc and the lockdown, which was intended to mitigate its effects, has changed life as we know it. Lockdown

The Covid-19 pandemic has caused great hardshipc and the lockdown, which was intended to mitigate its effects, has changed life as we know it. Lockdown

The Mauritian government implemented several incentives that make Mauritius an attractive option for foreigners to live, work and invest in. Tarissa Wareley, an Immigration Specialist

Public benefit organisations (PBOs) and NGOs are scrambling for funds to assist with the alleviation of poverty during the Covid-19 pandemic. However, people who want

Two Cape Town businesspeople have been sentenced to 16 and 17 years direct imprisonment for 487 counts of tax fraud, racketeering, money laundering and corruption,

TAX DODGERS TAKE NOTE On 1 February 2020, SARS released an exciting media statement, indicating that the revenue authority has embarked on a journey to

A Fin24 user planning to use their provident fund to emigrate wants to know whether they will be taxed after the first R22 500. They

Taxpayers may bear the full brunt of double taxation without relief. The proposed changes will put South African tax residents at a disadvantage, and with

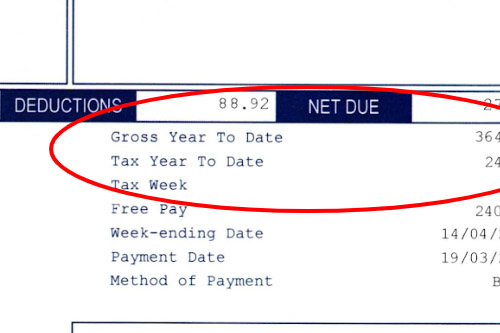

In terms of the Basic Conditions of Employment Act, an employer may only deduct funds from your salary if an agreement to do so has

South African Revenue Service (SARS) commissioner Edward Kieswetter has stated that the revenue service needs to prosecute tax dodgers to prevent a widespread tax revolt.

A wave of fraudulent tax refund letters was launched at unsuspecting taxpayers globally, according to Kaspersky’s Spam and Phishing Report for the second quarter of

CTF Services, 21 Kroton Street

Roodepoort 1709

Phone: +27 11 781 2588

E-mail: info@ctfsa.co.za

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. See our Disclaimer

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.